Help avoid Overdraft Item Fees with Balance Connect®1

How does Balance Connect®1 work?

With Balance Connect® for overdraft protection, if you’re about to overdraw your account, we’ll automatically transfer available funds from up to five eligible linked backup accounts to help you cover your purchase. This can help you avoid declined transactions, returned checks and overdrafts.3

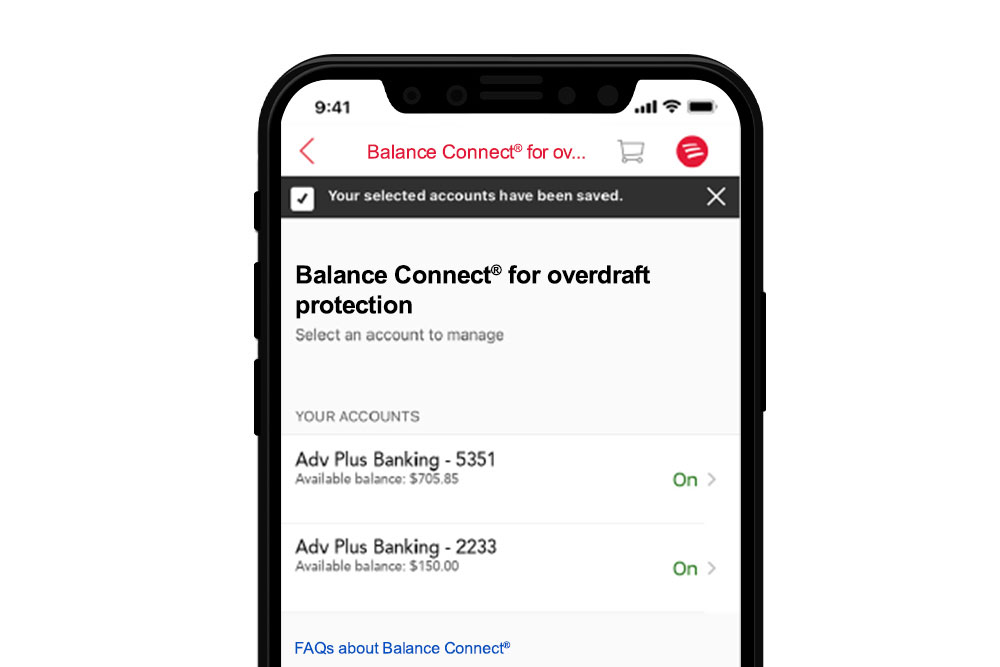

If you’ve linked multiple backup accounts, we’ll automatically transfer available funds from those accounts in the order you set in your preferences. You can enroll and manage your preferences easily in the Mobile Banking app4 or Online Banking.

Note: Balance Connect® for overdraft protection is not available with Bank of America Advantage SafeBalance Banking® or Bank of America Advantage SafeBalance® for Family Banking as a covered or linked backup account.

It's easy to enroll and manage your preferences

-

Manage

your preferences quickly and easily in the Mobile Banking app4 or Online Banking.

-

Link

up to five eligible Bank of America® backup accounts, such as another eligible checking account, a savings account or a credit card.

-

Choose

the order of the accounts you use to help cover your transacations.

Don't have a backup account?

We have a range of different eligible account options to choose from.

Checking accounts that help keep up with your life.

A savings account that can help you reach your goals.

Find the right credit card that suits your needs.